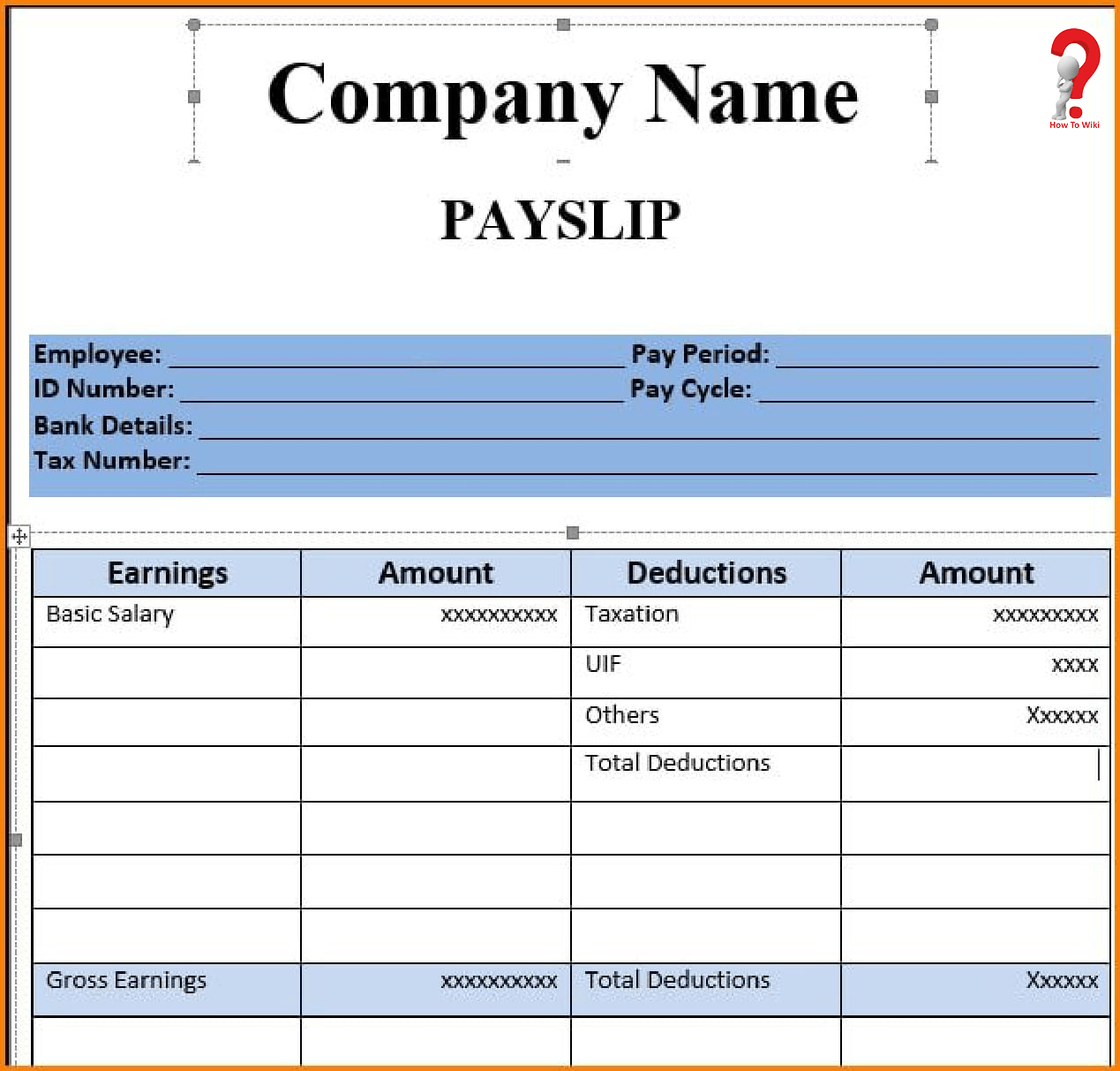

The payslip mainly informs the employee of the gross pay, … herod s lost tomb herod s lawġ8 Free Salary Slip Templates - Best Office Filesĩ Ready-To-Use Salary Slip Excel Templates - ExcelDataPro WebPayslip or salary slip is a document record that employers give to employees each time they receive their earnings. When you are given your monthly salary, you are often given a salary slip along with it. We provided a download option to download it free. This template includes monthly salary, category, annual Tex calculation, less rebate, etc.

Steps to Create a Driver Salary Slip Format in Excel.

Top 14 Free Payslip Templates – Word Excel Templates salary slip format excel download mean Payslip Template in Excel Build a Free Excel Payslip … 60+ Salary Slip Templates for Free (Excel and Word) - TemplateHub Ready-To-Use Simple Salary Sheet Excel Template - MSOfficeGeek

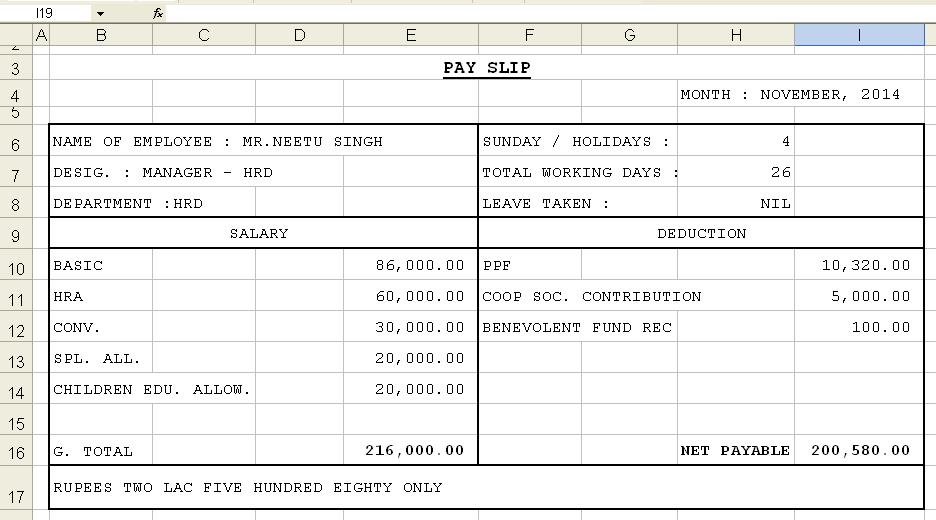

Payslip Format, Download Salary Slip Format in Excelġ8 Free Salary Slip Templates - Best Office Files salary slip format excel download mean The intention behind distributing such a document is to supply the details of the salary of an employee. It’s a legal document that is described as a genuine certified document issued by the company.Useful Salary Slip Formulas 1īasic wage + HRA + Conveyance + Medical + Special allowancesĠ.75% of employee gross wage.Salary slip format excel download Salary Slip Templates/Formats for MS Word & Excel Download Web Step 7: Now take out the printout of the salary slip and sign it and distribute to employees.

Step 6: Now subtract all the deductions from the earned gross salary of the employee in that particular month, the balance amount will be the net salary of the employee. Other(Special) Allowances (Balance allowances) HRA (40% of the basic wage for nonmetro cities)Ĭonveyance Allowances ( 1600 Rs in urban areas) Step 5: In another column add deductions such as EPF, professional tax, ESI/health insurance, TDS, salary advances, etc… Salary calculation formula for the total paid days = (Original gross salary/Total days in the month) X Paid days in that month. The sum of all the earnings will be called the actual gross salary of the employee. Step 4: Now in one column add all the earnings of the employees such as basic wage, house rent allowances, conveyance allowances, medical allowances & special allowances.

0 kommentar(er)

0 kommentar(er)